We are pleased to share that our Milwaukee, Philadelphia and New York facilities are open for in-person research, as are many of our trusted facility partners.

As we reopen and with the goal of exercising extreme caution for the health and well-being of our clients, respondents and staff, we are taking extensive health and safety measures, including but not limited to

– Health screenings and personal protective equipment for all people on site

– Reconfigured spaces to maintain social distancing guidelines of 6’

– Safety and cleaning procedures

– Only essential staff on site

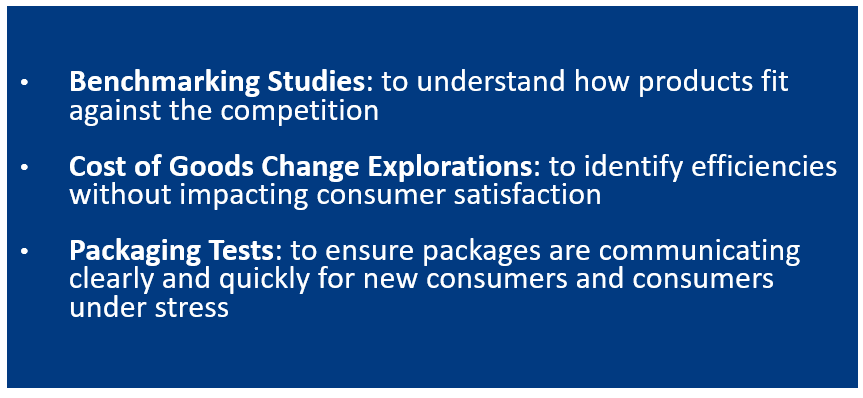

Most importantly, we realize that these unique circumstances may present challenges or concerns about your research. Please know that we continue to be your creative, collaborative partner. We will work with you to customize a solution that delivers the insights you need.

As we have done for the last 20 years, we remain committed to your research success.

We are excited about opening and delivering insights that help you navigate your path forward.