Some things may still be up in the air, but your qualitative research doesn’t have to be one of them.

Today’s online qualitative solutions go beyond the typical virtual group to deploy innovative approaches, leveraging the best tools, techs, and methods. And, online qual delivers six surprising benefits that help you move forward faster and with confidence:

1.Add depth of insight without adding complexity

In the online space, we can weave more elements into the project – online boards, virtual focus groups/IDIs – moving seamlessly from one to the other. What’s more – we can add these tools without adding complicated project coordination or extending lead times.

2. Engage with consumers using the best (and newest) tools and tech

Beyond traditional online discussions and video interviews, there are continual innovations in the digital space. We seek out these advances to help bridge the gap of remote research and, more importantly, uncover the most in-depth, productive insights from consumers.

3. Access information at your convenience

Respondent feedback is available immediately and 24/7. Client teams don’t have to turn their schedules upside down to attend live sessions. Still too busy to attend all of the virtual sessions? Recordings are available and easily accessible and machine transcripts – though sometimes imperfect – are good enough for achieving an immediate understanding of consumer feedback.

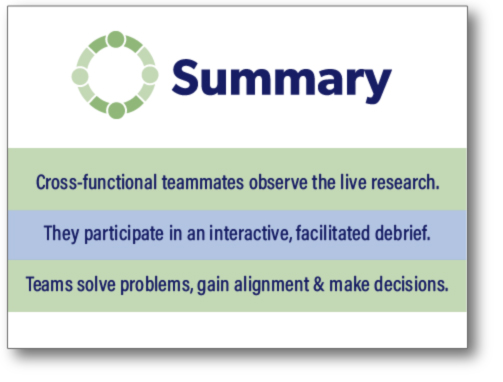

4. Get team alignment

The ubiquity of the platform enables more teammates to be involved first-hand, rather than prioritizing who travels or whose schedule takes precedence. This enhances team alignment and helps everyone move forward quickly.

5. Achieve tight timelines

From recruiting respondents to scheduling client teams, from allocating moderator time to organizing insights, online research frees up time across the board. This creates opportunities for qualitative insights that did not exist previously.

6. Expand research opportunities

Online qual is simply more cost effective. There are no facility rentals or travel costs, and respondent incentives can be lower since they too are not traveling. This leaves room for other projects, as well as for more robust methodologies that produce richer insights.

Bottom line: A Benefit, not a Bandaid

Online Qual lets us leverage the richness and flexibility of the online space. Just as cross-country families play games across the virtual void and international business associates collaborate on a singular document, so Online Qual brings opportunities for deeper insights that were not imagined previously. Let’s explore that landscape together!