Blueberry

The Challenge

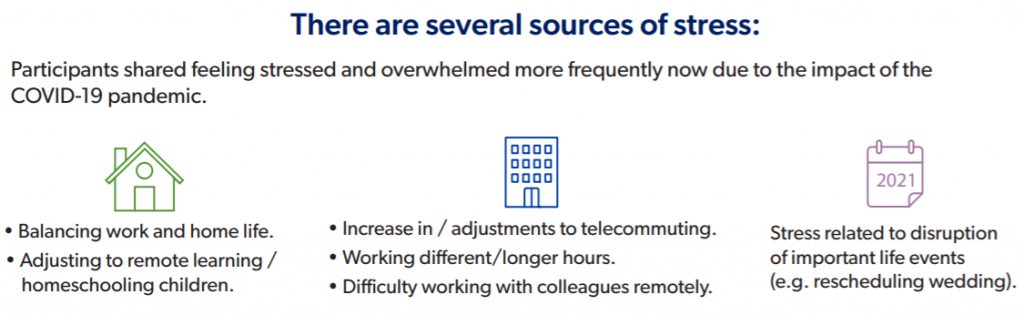

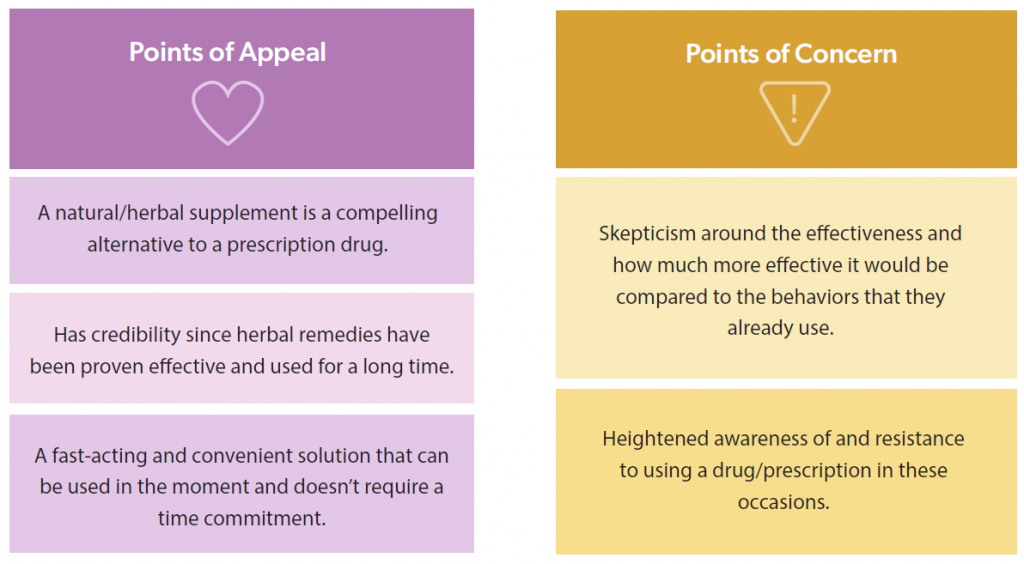

Our client was looking to launch a new supplement to help with stress and wanted to understand the factors that contribute to stress and what the opportunity would be for their stress management supplement.

Our Approach

We conducted a Home Use Test and also asked a subset of our Home Use Test participants to record how they were feeling prior to their trial of the product and then after using the product. After reviewing their videos, we selected some participants to participate in online, moderated group discussions. Four, 60-minute sessions were conducted with three participants per session.

What We Learned

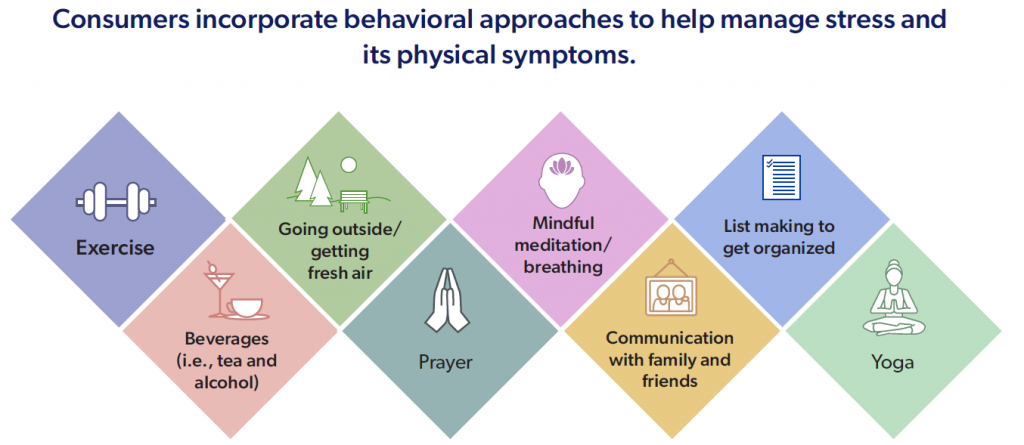

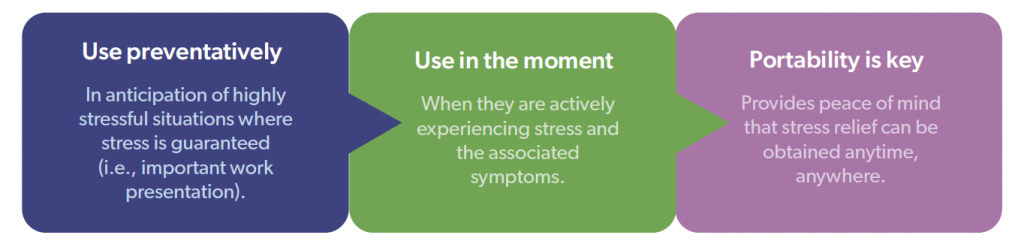

Some behaviors require more time, which is not always possible in the moment. Even with stress management techniques, anxious feelings aren’t easily cured and don’t always go away completely. Consumers spend the time to de-stress just to re-stress at the first sign of trouble.

Insights to Action

Most people are not currently using supplements to help calm themselves but would be open to it.

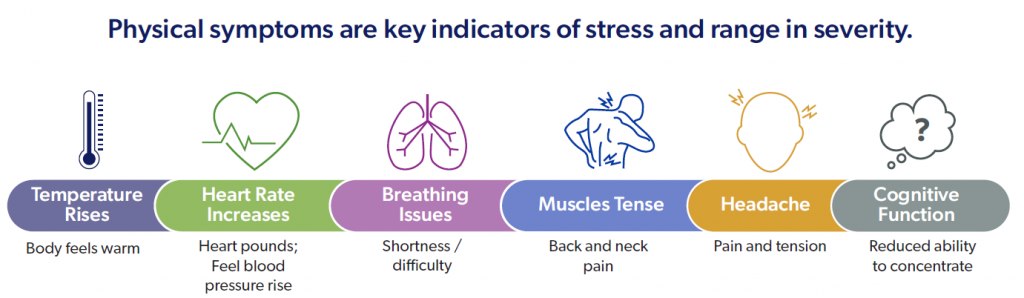

The primary benefit is feeling the relief take over (actually noticing the physical and emotional shift).

For the PDF, click here.

The Challenge

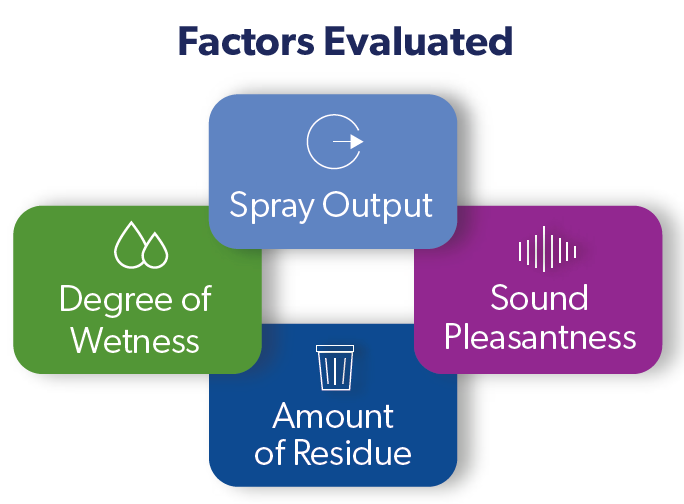

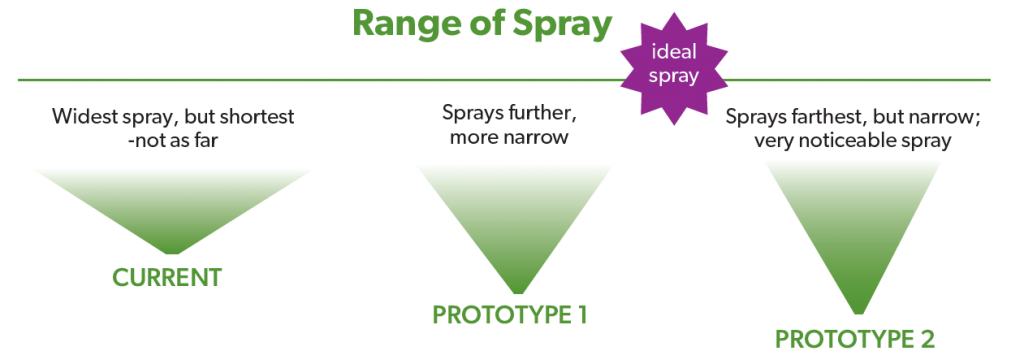

Our client wanted to improve their home fragrance spray product, which had received some negative feedback regarding wetness on surfaces. Two prototypes have been developed with different spray patterns, particle size, and improved fall-out from the Current product. Consumer evaluation was needed to understand if the new spray patterns are consumer noticeable and acceptable.

Our Approach

In a randomized order, and with direction from a test administrator, consumers sprayed and evaluated performance of two sprays: Current and one of the two Prototypes. All products utilized the same fragrance.

Panelists completed a questionnaire after each sample, and peel-off interviews were conducted to provide deeper insights. Interviews included spray characteristics of products at end-of-life to determine if there are any watch-outs.

What We Learned

– Prototypes are equally well-liked, although the amount of residue is more satisfactory from Current than Prototype 2.

– Consumers do notice differences in spray patterns/wetness between Current and Prototypes.

– There doesn’t appear to be a watch-out for end-of-life regarding fragrance or sound.

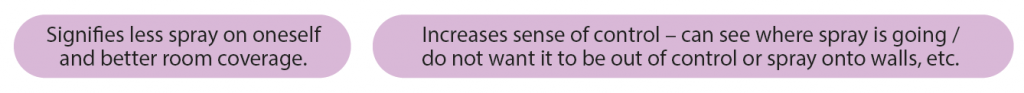

– There is a segment that desires to see the stream of spray and angle, present in the Prototypes versus the plume of Current:

Insights to Action

Rather than moving forward with one of the Prototypes, we recommended an iteration of the two.

For the pdf, click here.

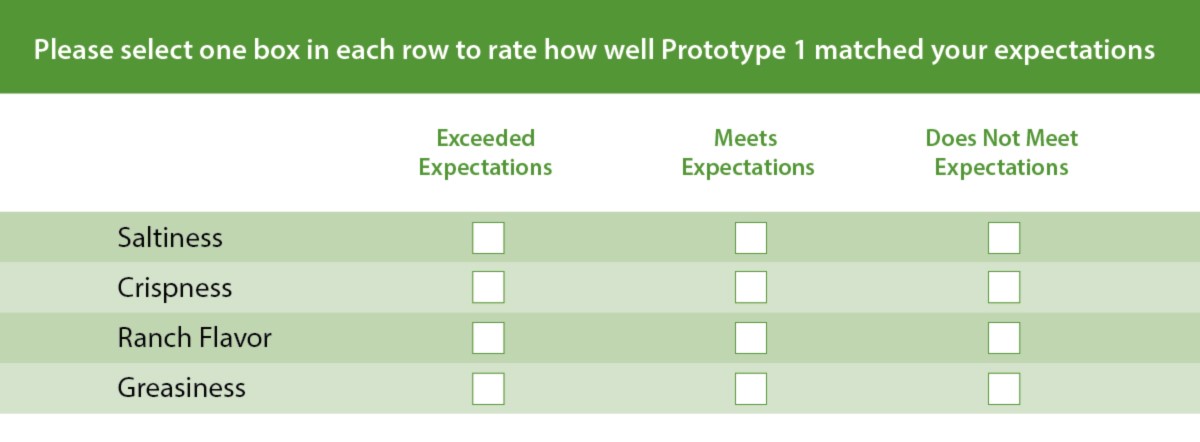

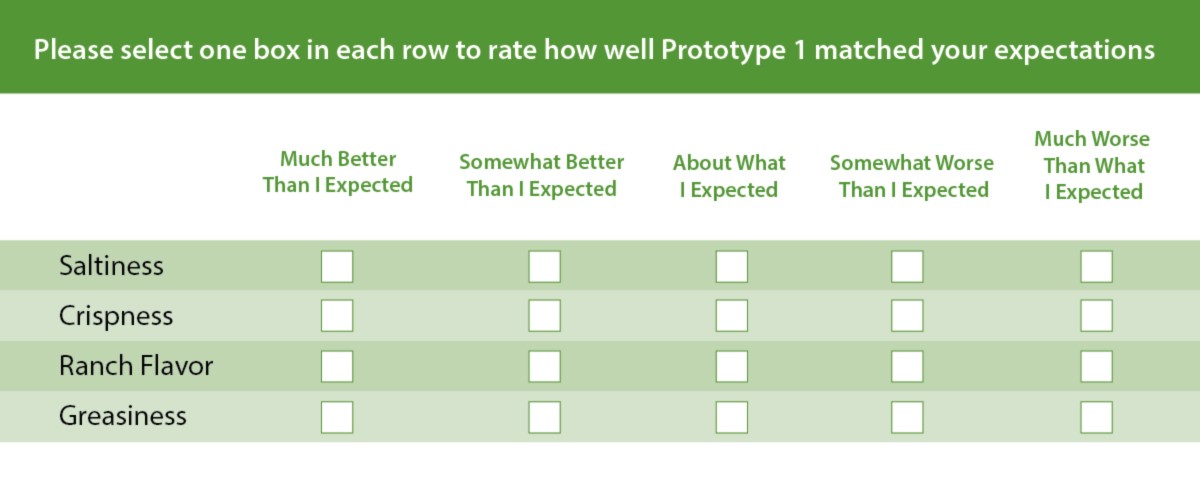

Recently, we were collaborating with a client about a project, and she asked us which Expectation Scale we should use – 3 or 5 point.

If you’re not familiar with Expectation Scales, this is what they typically look like:

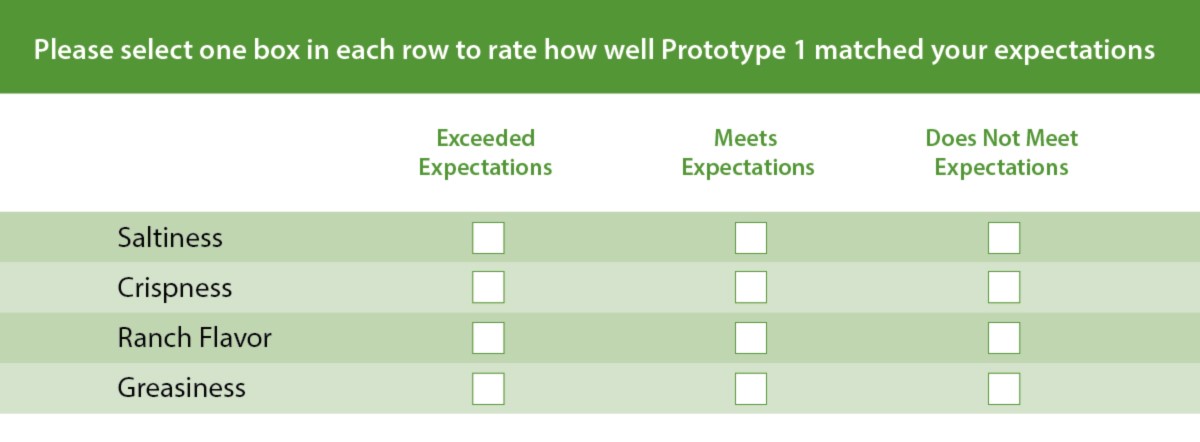

This is a 3-Point Expectation Scale:

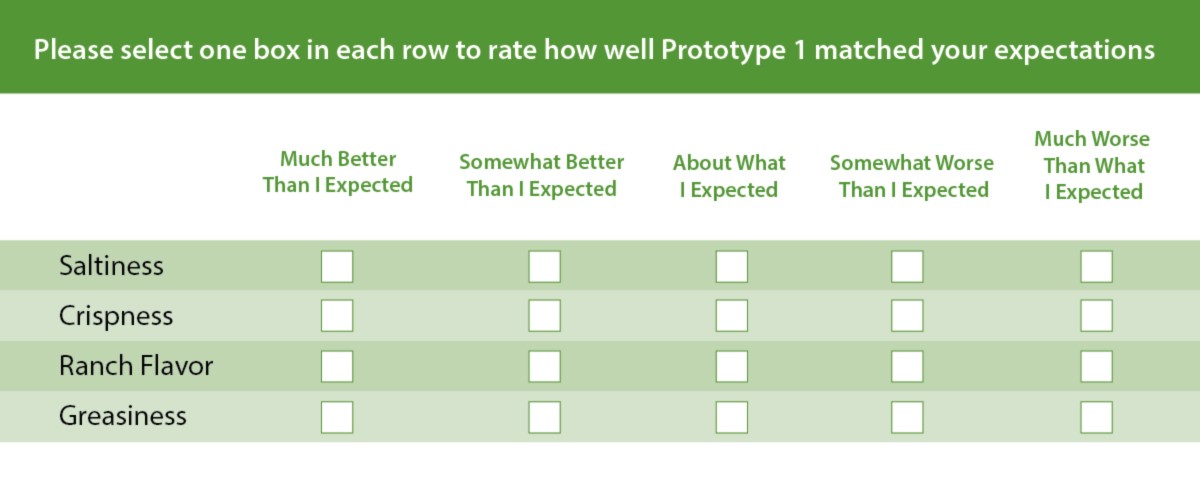

This is a 5-Point Expectation Scale:

Expectation Scales are widely used in market research. They are:

– easy for people to understand

– can be deployed in virtually any category

– provide definitive information across a multitude of factors

So, they have a lot going for them!

While the 5-Point Expectation Scale is useful and widely popular, the 3-Point Scale is easier for consumers to work with, and it carries more meaning for the researcher when it comes to analysis.

The beauty of a 3-Point Scale is that it does not leave room for a gray area. It requires that the consumer make a definitive answer – positive, negative, or neutral. While the 5-Point Scale might soften the blow a bit for an under-performing product, it also can artificially boost an average product. On the other hand, the 3-Point Scale leaves minimal room for error – either positively or negatively.

I think of our preferences for expectations scales a bit like our preferences for removing a band aid – you can go slowly, taking off the edges bit by bit until you peel it off – that’s a 5-Point. Or, you can go fast and just rip it – yup, that’s the 3-Point! Now, which one are you?

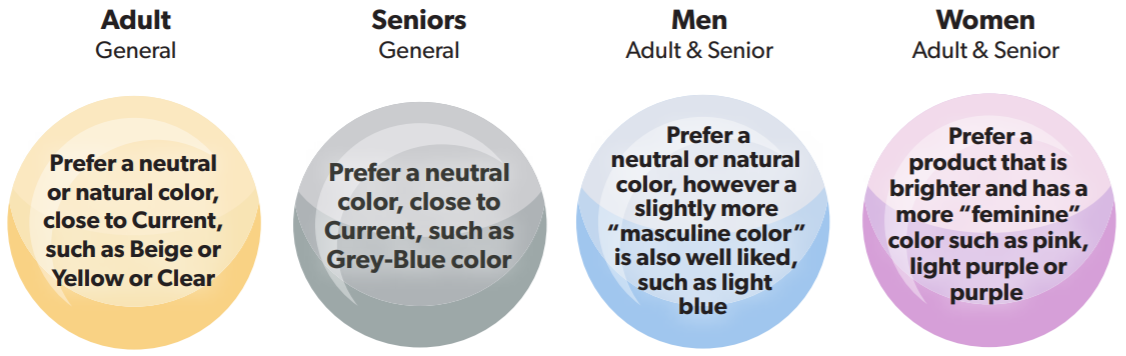

The Challenge

Our client is working towards the removal of artificial colors from a healthcare supplement product line, with the goal of creating a more ‘natural’ product.

1. Obtain feedback on an initial production line with more natural colors

2. Understand potential issues that may arise with these changes in colors

Our Approach

We conducted a Central Location Test to evaluate six different variants, including the Current. Aside from standard hedonics, we included just-about-right measures, so we could conduct Penalty Analysis to determine where to optimize in terms of color and size, if need be.

Following the product evaluation, peel-off In-Depth Interviews were conducted to obtain additional understanding around the colors.

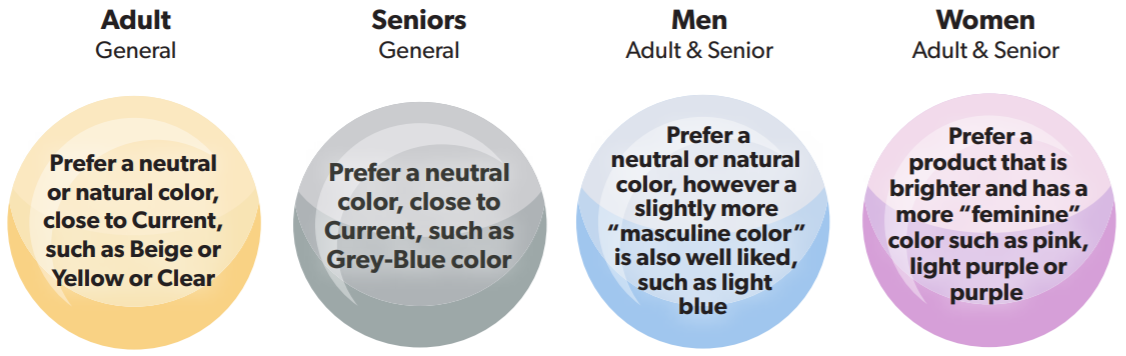

What We Learned

Purchase Decision Factors (in Priority Order) are:

– Brand – Trust is key

– Efficacy – Should do what it says it does, particularly if gender or age specific

– Size – Should both look easy to swallow and be easy to swallow

– Color is not necessarily important. Most consumers could not recall what the color of

their supplement was. Still if encouraged to choose, consumers had some color preferences:

Insights to Action

Current consumers strongly believe in the brand’s reputation and efficacy. So while the brand is “internally” pressured to make this change, a change “within reason” will not deter brand usage – as

trust in the brand overrides the color of the tablets.

Further, current consumers already believe the tablets to be natural, so while the company desires to state this on the package as a benefit, it may cause consumer concern and lead consumers to question their prior experience with the product.

Overall, there is not much concern in making this switch, but there are some issues around specific colors, which came out in the qualitative interviews…

Want more? View the case study.

The Challenge

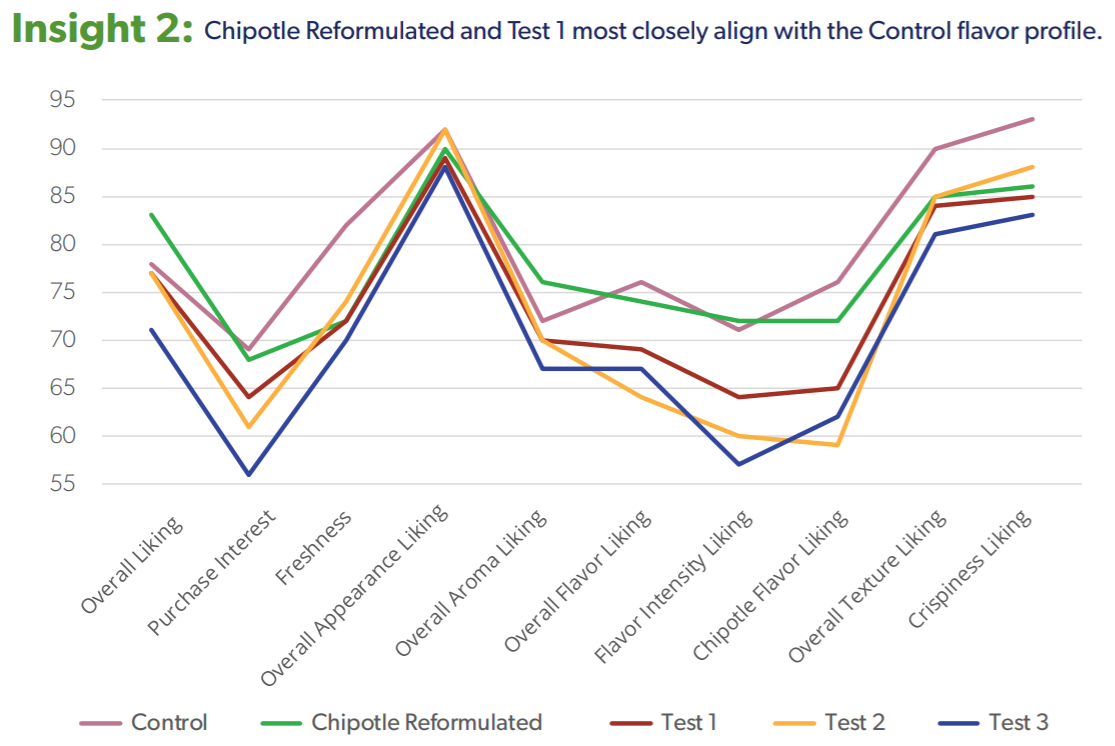

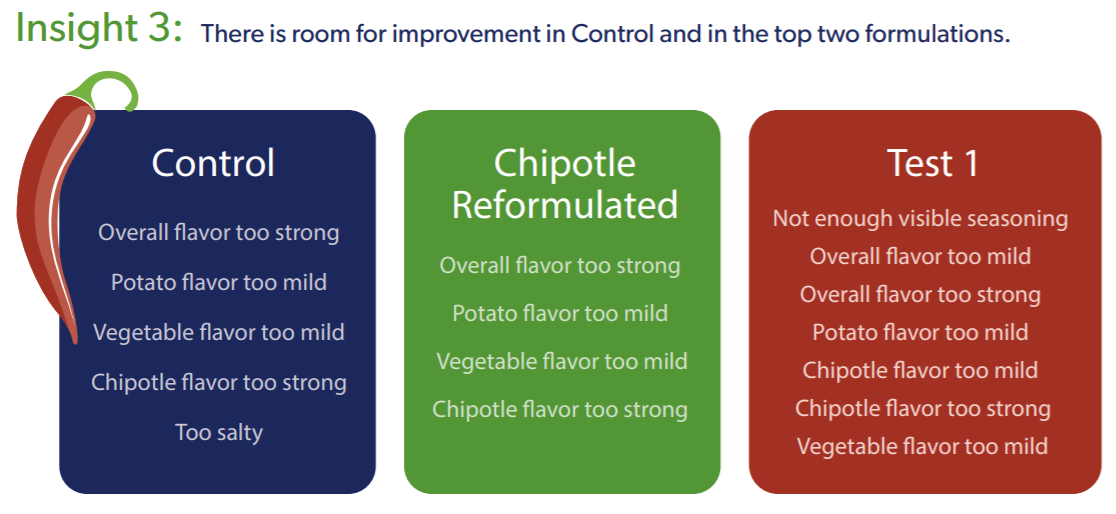

Our client is considering a different formulation for its Chipotle Veggie Chip and wants to ensure there are no discernible differences between the reformulations and Current. The reformulations include one prototype using a new flavor house and three prototypes using reduced seasoning levels from the current flavor house.

Our Approach

Compare the current formulation to the revised prototypes to determine if consumers equally accept any/all formulations. And, determine any optimization priorities for the new formulations to ensure they deliver as well as Current.

What We Learned

Insights to Action

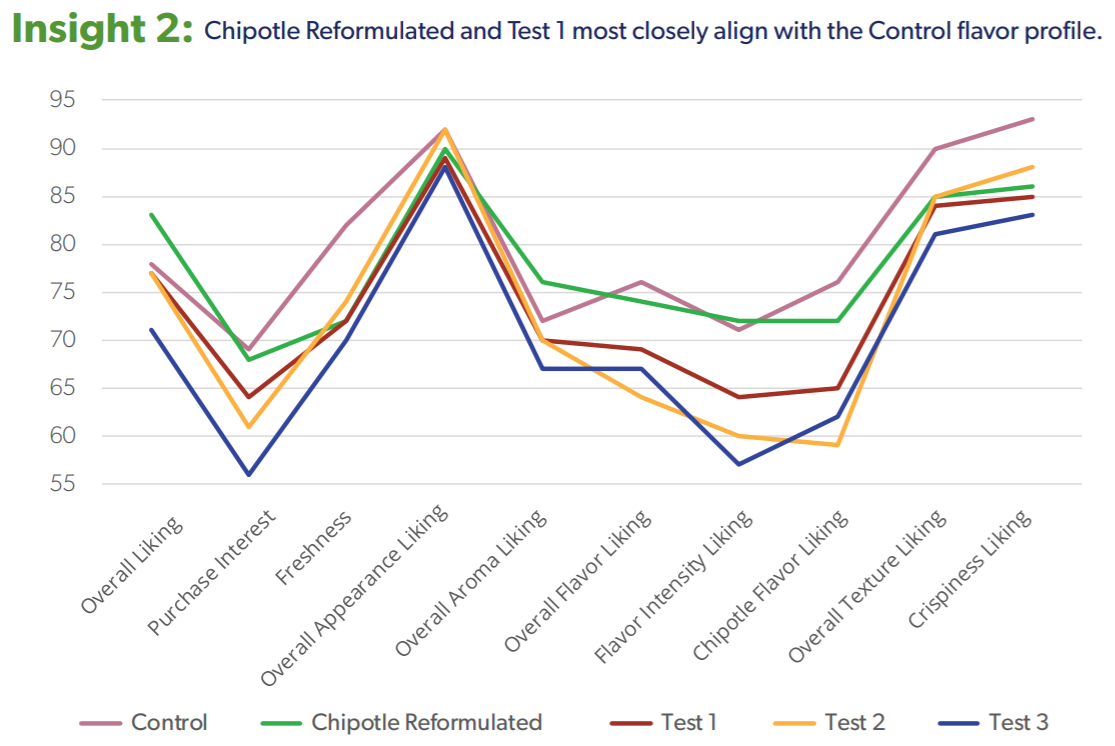

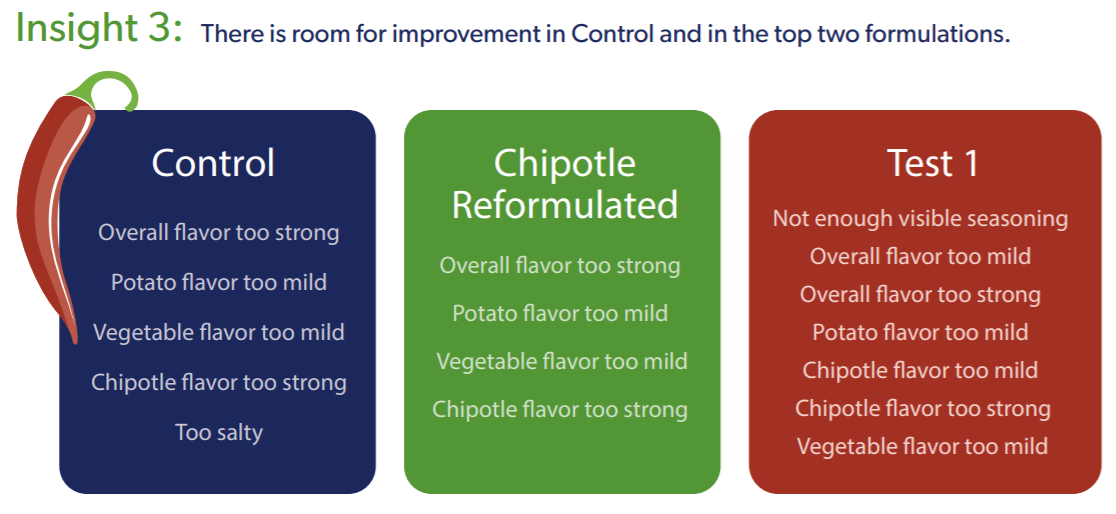

Although Control, Chipotle Reformulated and Test 1 are equally liked for nearly all measures,

Chipotle Reformulated is significantly better optimized for vegetable flavor over Control and Test 1

and better optimized for chipotle flavor over Test 1.

Still, there’s risk in switching to Chipotle Reformulated, as it does not emulate the current Veggie

Chip profile in the same manner in which Test 1 does. Flavor differences detected in Chipotle

Reformulated could indicate that this formula is more “potato-chip” like, thereby potentially

alienating current consumers.

Want more? View the case study.

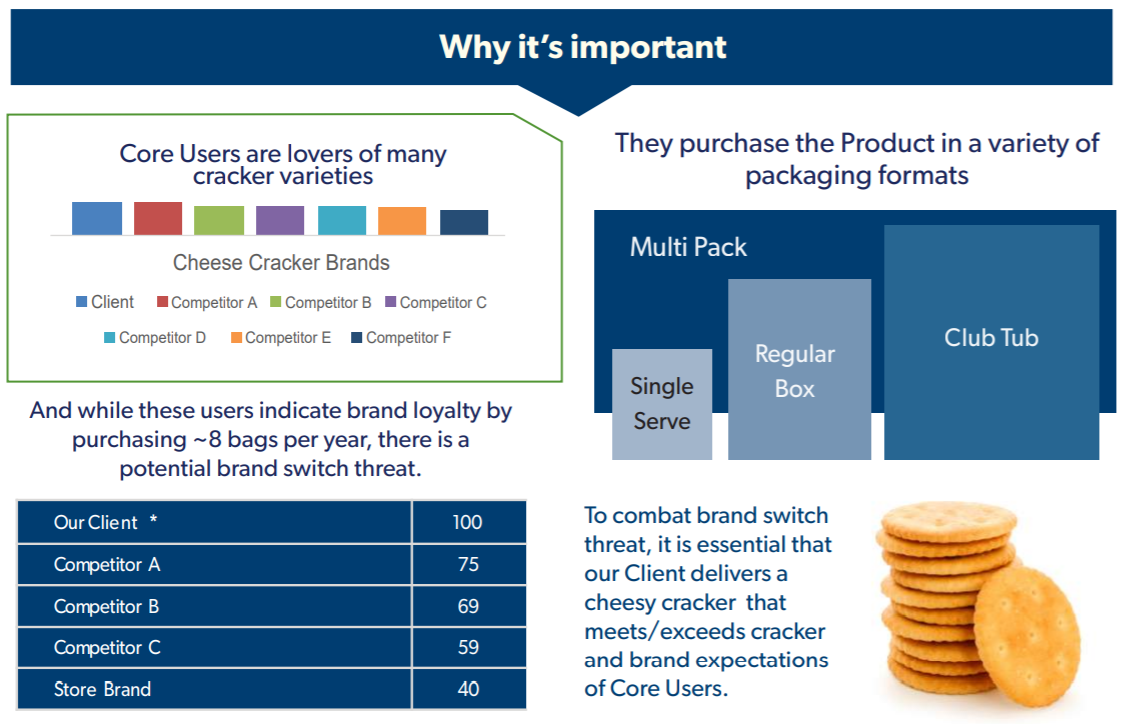

The Challenge

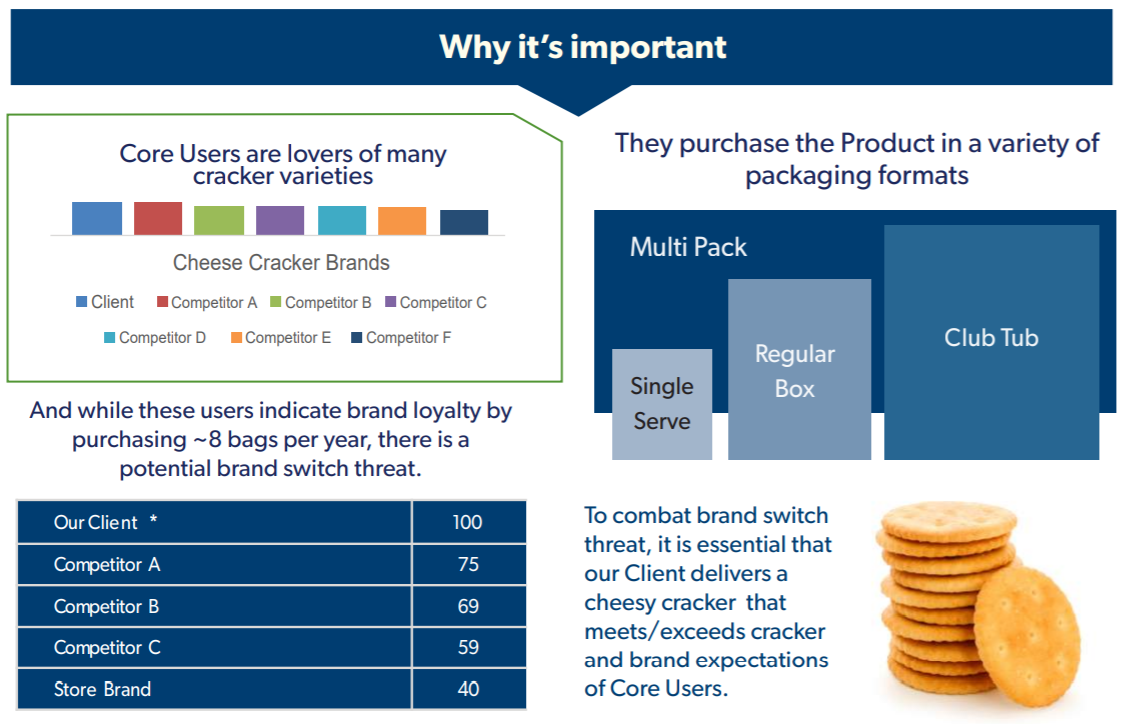

Can we reduce overall cheese content by 10% in our cracker product without negatively impacting consumer perception?

Our Approach

Test the current product against the test product with both medium and heavy brand consumers to determine if consumers equally accept the test product.

What We Learned

Heavy brand users were able to identify differences between the current and test products.

However, heavy brand consumers also purchase competitive product just as frequently. Since the proposed ingredient change resulted in a slightly less satisfactory product, if implemented, these flavor and texture differences present a risk to the franchise and may erode perceptions of the brand over time.

If this change has to be implemented due to productivity (cost of goods reduction), we recommend that our client enhance flavor and texture perceptions.

Click here for the full case study.

We get it. Digging through pages of website data is a hassle. So, here’s a quick view on what we offer. The gist – we’re a full-service marketing research agency, which means qualitative, quantitative and sensory research, and we do it all. . . anywhere your research takes you.

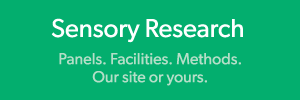

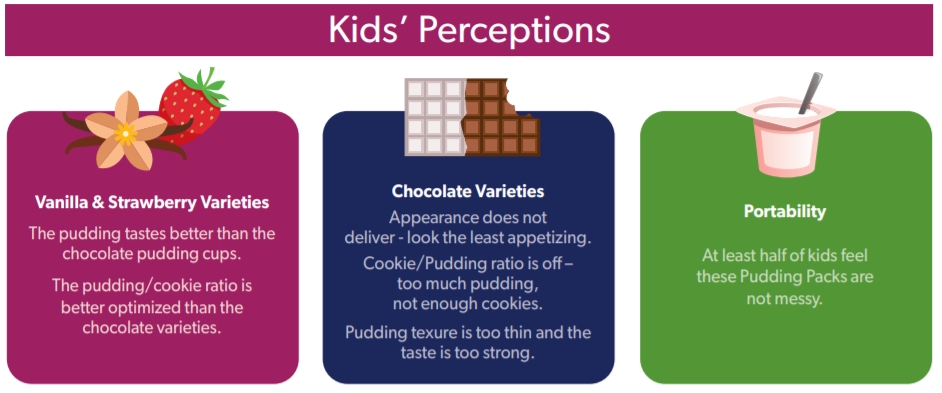

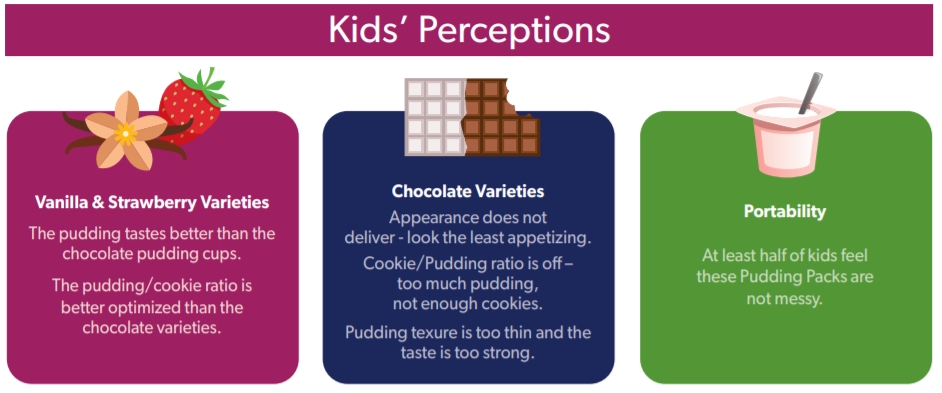

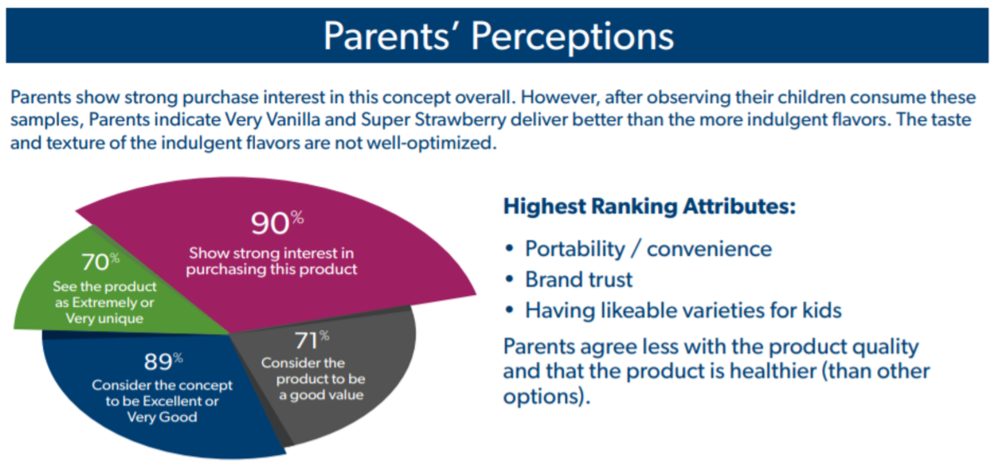

The Challenge

Our client launched a Kid’s Pudding Pack line that did not perform as expected in market. Post-launch they wanted to understand consumer perceptions of the offering and product performance to help increase sales.

Parents evaluated the concept and observed their kids’ evaluation of the products to provide a balanced perspective in order to determine what optimizations could be made to enhance these products.

Our Objectives

Determine barriers to purchase among parents based on the concept.

Determine kids’ & parents’ overall reactions to the offering.

Gain a detailed taste evaluation from the kids.

Understand specific concept likes & dislikes and disconnects in the product experience.

What We Learned

Parents and kids liked the Pudding Pack concept with Very Vanilla and Super Strawberry as the top contenders.

Broken cookies are a problem, because it erodes perceptions of quality and diminishes perceptions of ease of use.

The product was considered portable and not too messy.

Click here for the full case study.

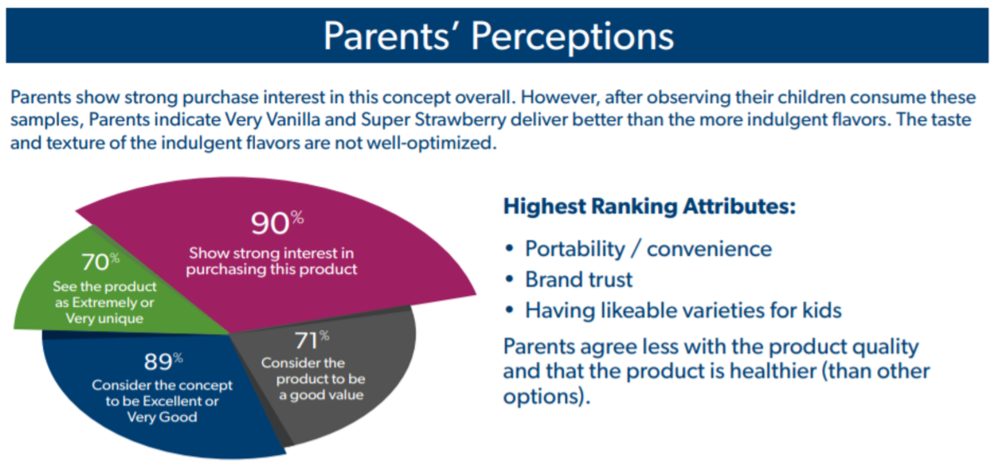

The Challenge

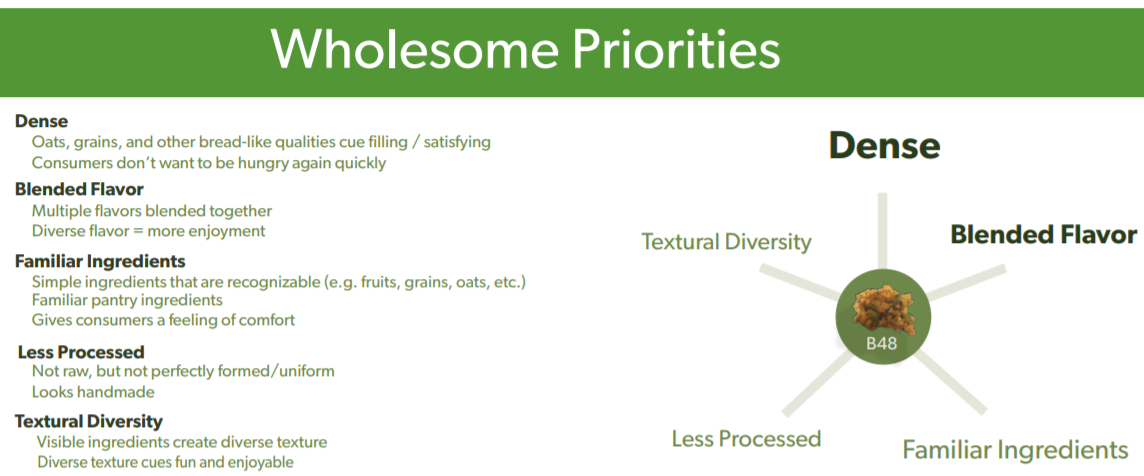

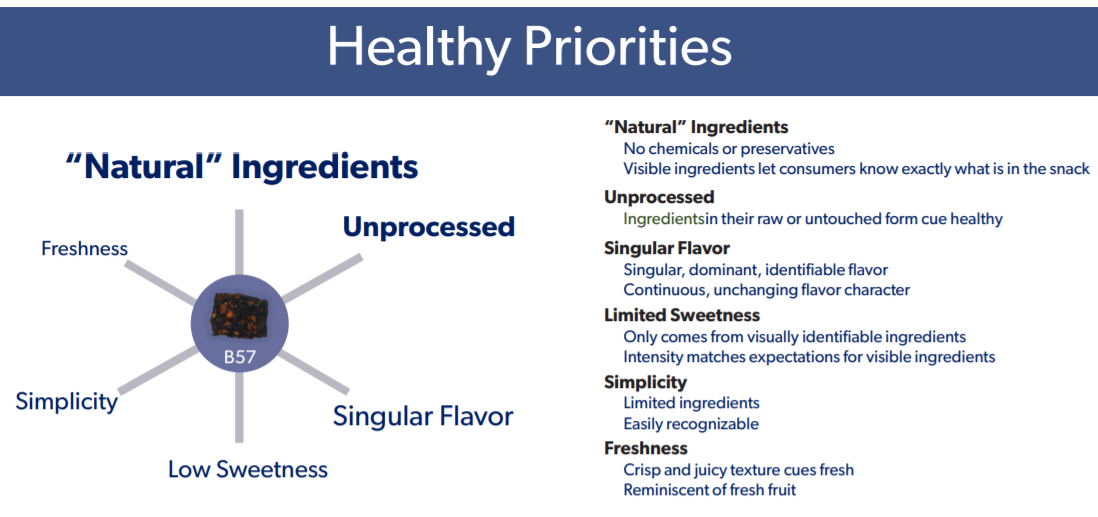

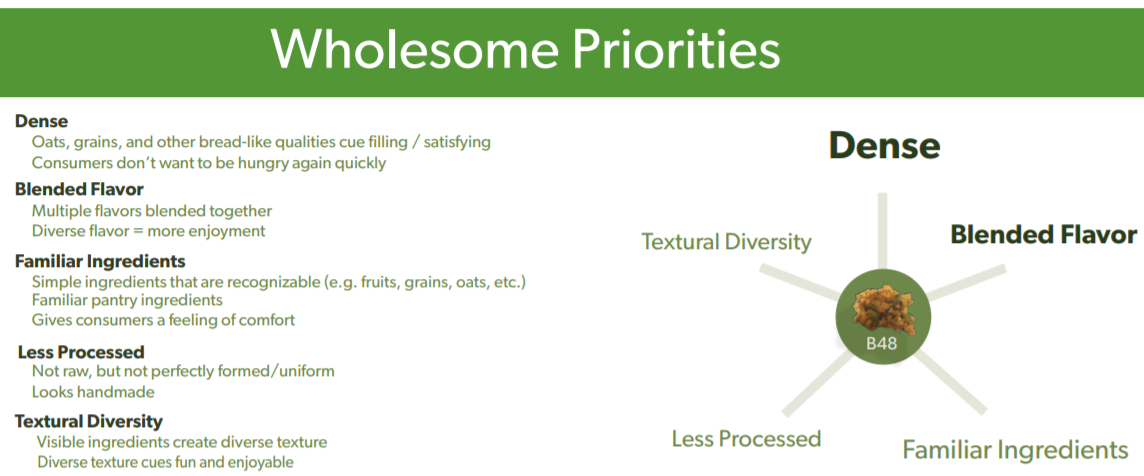

As marketers and market researchers, we know that words are pretty important. We have to understand what a word means to consumers and what they really want when they say that word. We explored this dichotomy as it relates to snacks in our Healthy versus Wholesome poster for The Society of Sensory Professionals.

Our Approach

Explore the differences and desired product attributes for healthy and wholesome snacks.

Phase 1: The Snack App

Consumers log their snacks for 24 hours and answer questions about their snacks.

We use the data to inform our lines of questioning and stimuli for focus groups.

Phase 2: The Focus Groups

Consumers complete pre-work assignments prior to meeting in the groups. Work includes journaling about snacks and uploading photos.

Consumers participate in different focus groups – one discusses the meaning of wholesome snacking, while the other discusses what healthy snacking is.

Insights to Action

While the occasions for healthy and wholesome snacks are the same, there are differences in the sensory attributes and emotional benefits of each. In developing a snack bite with “healthy” or “wholesome” positioning, Product Developers should focus on the prioritized sensory cues in order to create an aligned and satisfying experience.

Want more? (View the poster.)

The Challenge

Our client was working on a line extension for an iconic frozen brand. The team wanted to determine how far they could stretch the product offerings within their brand portfolio, by introducing a line of frozen sandwiches.

Our Approach

Conduct a central location test to determine product-concept fit.

Determine if category users give client permission to extend brand into the frozen sandwich arena and understand the potential for this line extension.

Insights to Action

The desired product benefits in the concept were not strong enough to outweigh the weak product

delivery. Specific product guidance was provided to help guide product optimization.

The competitive context for these sandwiches is not other frozen products, but rather fresh alternatives, whether made at home or from a Quick Service Restaurant.

Although the pricing for these prototypes is slightly lower than Quick Service Restaurant pricing, the

prototypes were not able to deliver the same level of satisfaction as their QSR competitors.